- Posted 2nd August 2015

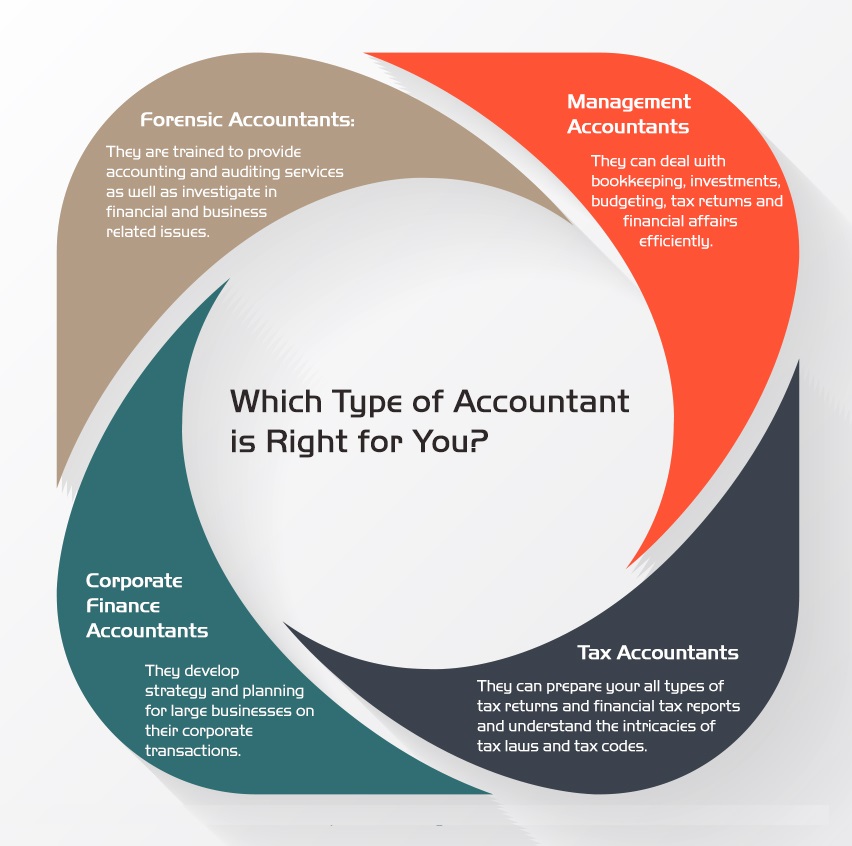

Which Type of Accountant is Right for You?

Is your business poorly managed? If yes, you need to find and choose a right type of accountant who can help you with the smooth operation of your business.

But, wait before you jump into choosing accountants, you first must know about the types of accountants available.

Forensic accountants

Specialist forensic accountants are the ones who specialises in a special area of forensic accounting. Such accountants are trained to provide accounting and auditing services as well as investigate in f...

- Posted 30th July 2015

Is ‘7 Day Working Policy’ Fair for Doctors?

With the constant ongoing debate on ‘seven working policy’ between Health Secretary Jeremy Hunt and the GPs, anyone can assume that this battle will not settle easily.

As the government seven day policy has been already declared, so is the war between the government and the British Medical Association representing doctors.

Contrary to this fact, is it fair for all the doctors to work even in the weekends? Well, it would not be right to impose this rule on the doctors because, like ever...

- Posted 29th July 2015

Four Common Accounting Mistakes to Avoid

If you have to name one part that your business, mostly tend to make mistakes at, you would probably say it is the accounting section.

As accounting mistakes can range from minor to major ones, you need to remember that such mistakes can seriously hamper your business.

Here is a list of common accounting mistakes that you should avoid in order to improve and maximise your business’s wealth.

Mixing your personal expenses with business expenses

Do you use your company’s accounts to pay fo...

- Posted 28th July 2015

Top Three Causes of Cash Flow Problems

A cash flow problem can be very difficult to live with. It is still a significant challenge that a large number of businesses face today.

So, what are the factors that cause cash flow problems in your business? You need to read on below to find out.

Bad collection on your cash receivables

After you make a sale of any products or services of your company, it is important you collect the costs on that sale in a timely manner. That is because if you fail to collect the owed amount at the r...

- Posted 27th July 2015

Top Three Legal Ways to Avoid Inheritance Tax Bill

If your estate (property or possessions) is worth more than £325,000 (Inheritance Tax Threshold) when you die, then you are required to pay Inheritance Tax (IHT). Despite this fact, there are some ways which you can implement to avoid your tax bill.

To know what they are, read on the points below.

Make a gift

When you are married or in a civil partnership, giving away anything you own as a gift to your partner will be free from Inheritance Tax but is only available if you live in the U...

- Posted 23rd July 2015

Tax: Overpayments & Underpayments

Whether you’re employed or you get a pension, it is the duty of HM Revenue and Customs (HMRC) to check if you’ve paid the right amount of tax or not.

HMRC may post you a P800 tax calculation. Such P800s are usually sent by them by the end of September after end of tax year mainly if you have finished your old job and started a new one in the same month, started receiving pension and employment support or job seekers allowance.

Remember, if you are registered for self-assessment, you wo...

- Posted 22nd July 2015

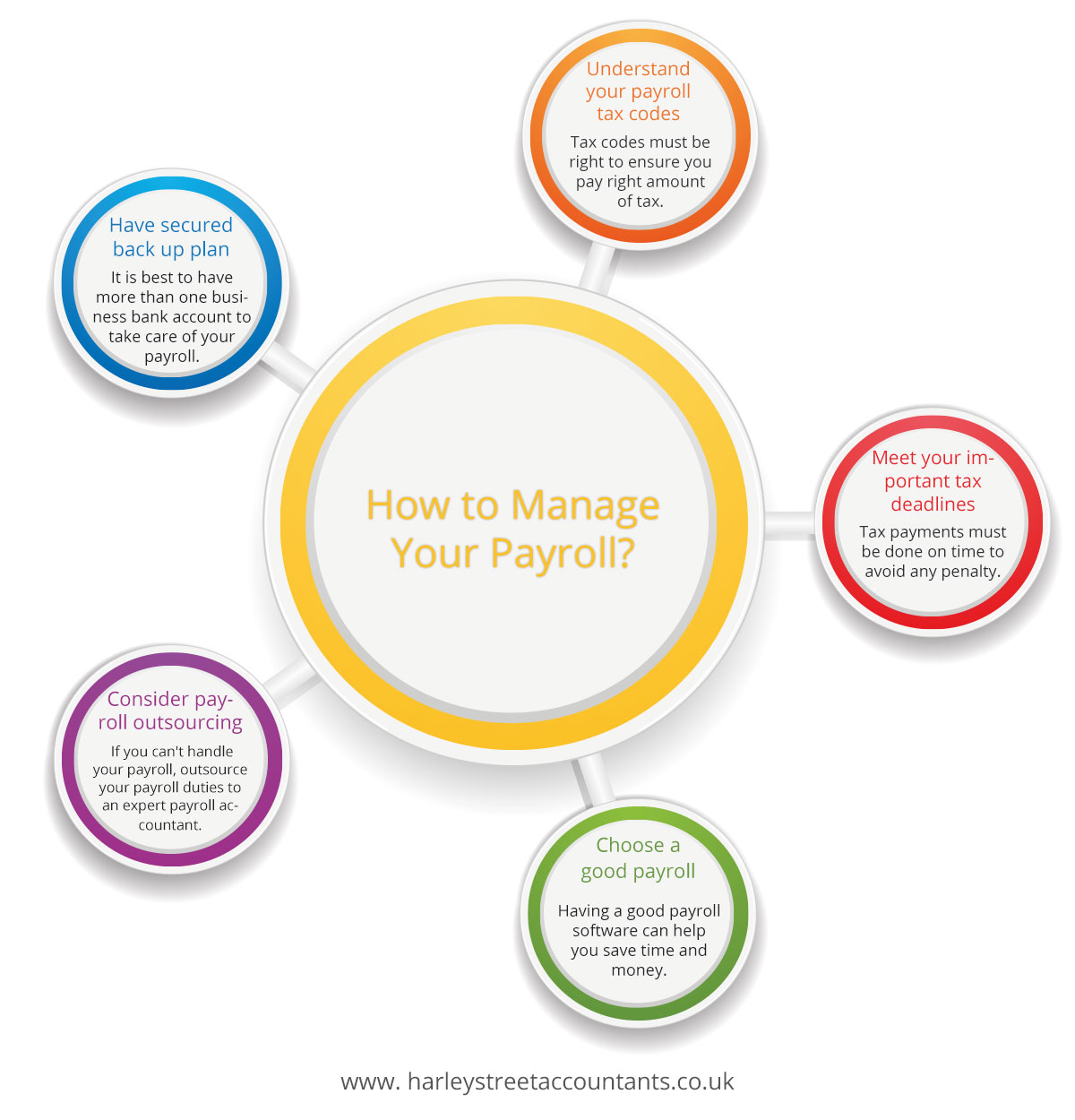

How to Manage Your Payroll?

Are you having payroll problems? If you are, then you should quickly solve it before it is too late.

As the success of your business depends on smooth running payroll, you need to make sure to get your payroll right. And, to help you make your payroll easier, here are some useful tips for you.

Understand your payroll tax codes

If you get your tax codes wrong, you may have to pay a lot more than you are liable to. As tax codes can be changed for salary, benefits, past employment and ma...

- Posted 21st July 2015

Corporation Tax Penalties

If your company is liable for Corporation Tax, you are required to complete, submit and pay correct tax returns to HM Revenue and Customs (HMRC) on time. If you don’t do so, then you may face a penalty.

For completing and submitting accurate tax returns, you need to have all your business records. Furthermore, HMRC may ask you for such records. That is why you need to keep records of your business transactions.

If your company is liable to pay corporation tax but doesn’t receive a ‘Notic...

- Posted 20th July 2015

Impact of Summer Budget on Dental Professionals

The summer budget was announced by the Chancellor, George Osborne on 8 July 2015. The changes brought by this budget have some impact on dentists and dental practices.

Annual Investment Allowance (AIA)

Before the announcement, the current limit of £500,000 was due to reduce to £25,000 on 1 January 2016. Now, the AIA would be increased to £200,000 permanently from 1 January 2016. So, it is a good news for the dental industry because it usually spends a lot money plant and machinery.

E...

- Posted 17th July 2015

Tax Reliefs

Tax relief is the reduction in amount of tax that is to be paid by an individual or a company entity.

When you use your own money for travelling or buying things for your job, you may be able to claim tax relief. However, you cannot claim reliefs on the things you use in your private life.

In case if your employer has already provided you with an alternative or has paid back your expenses, you no longer can claim relief on things you’ve spent your money on. You also need to maintain records ...