- Posted 11th March 2015

Self-Assessment Tax Return-What you need to know?

Self Assessment is a system used by the HM Revenue and Customs’ (HMRC) for collecting Income Tax.

Taxes should be paid to H M Revenue & Customs (HMRC) on the two set dates. They are made in two instalments. You need to pay the first one on 31st January for the tax you owe on the previous year or second one on 31st July.

A tax accountant can help you complete a self-assessment tax return form online or on paper on the set date 31st January, 2015 and 31st October, 2014 respectively. In cas...

- Posted 11th March 2015

Why is an Accountant Important for Surgeon?

A surgeon specialises in treating the ill patients needing an operation. If you are a surgeon, the daily routine of operating on your patients may make you tired and put in stress. Between patients, stress and weariness, you may not be able to give the attention for the financial aspect of your practice.

Finance is a major part of your practice. Without a good finance, your practice can barely survive. For managing finance, the knowledge about several things like accounting, tax, VAT, HMRC rule...

- Posted 11th March 2015

Non Taxable Incomes in the UK

In the previous blog, we had mentioned about the taxable income and it’s types. Now, we will be giving you insight about the non-taxable incomes where you can ignore the taxes. If you do not want to include non-taxable incomes in your tax calculations, it is important you know about them.

What is non-taxable income or tax free income?

Non taxable income is a income exempted from taxation by law. So, this type of income is not subjected for any tax purposes.

Welfare benefits

These benefits ...

- Posted 11th March 2015

What Types of Income is Taxable?

Income tax is an amount that you pay on your income. There are few types of income which is not accountable for tax i.e. non-taxable but most of income types are taxable in the UK. So, what types of income are taxable? Find out about it all on the following points.

Taxable Income

In the tax terms, the taxable income is the one where you have pay tax on it. The taxable income includes:

Earned Income

Wages and salaries from full, part-time, and temporary employment including...

- Posted 11th March 2015

When Should You Hire an Accountant?

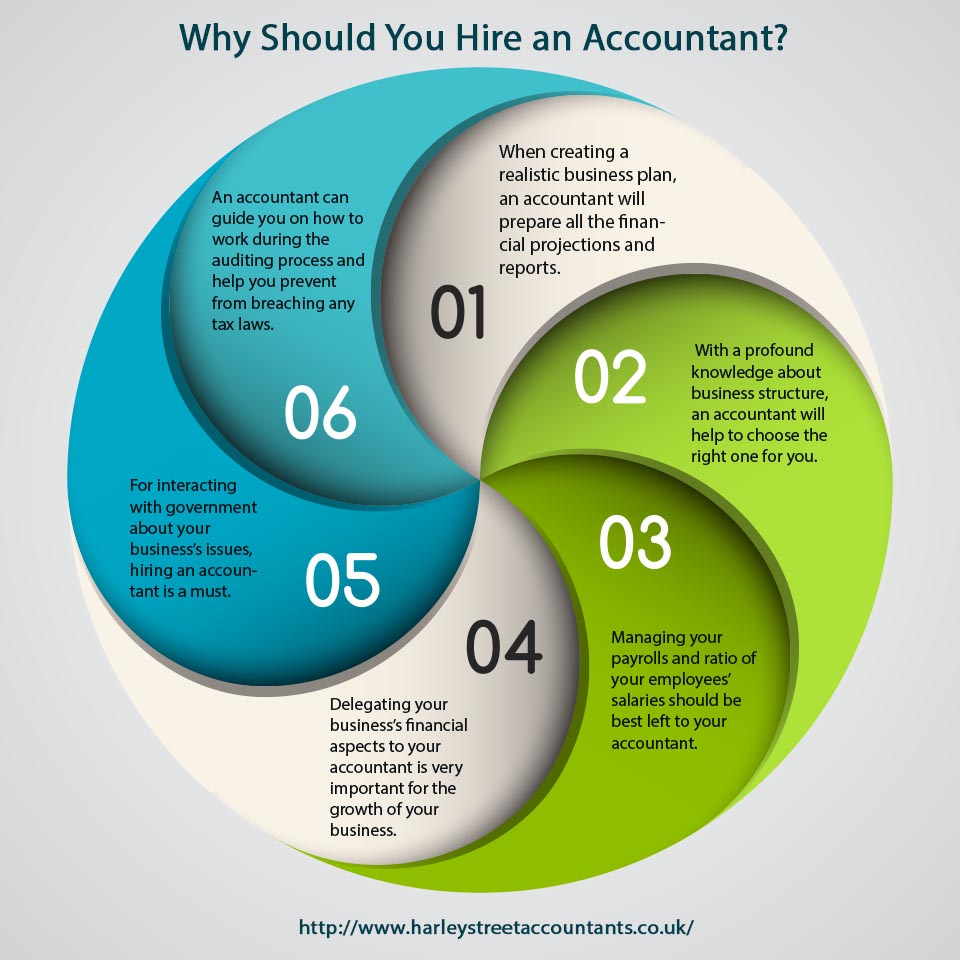

Professional accountants have a vital role in the success of your business. From collection to accuracy, payroll to tax returns, recording to analysis of company’s financial operations, they can easily handle all of these functions.

Accountants can be of a great help at different phases of your business. So, when should you make a decision to hire an accountant to represent your business? Here are some situations where having a professional help is all what you need.

Making your business p...

- Posted 11th March 2015

How to Reduce Your Tax Liability

Let’s face it! Paying your taxes is one of the most important financial priorities which you cannot possibly overlook. When it is about paying taxes for your business, it can become quite difficult to manage the tax payment when you are struggling for holding up the capital to run your business.

Here are five common areas where your and any other business should address to for reducing tax liabilities.

Efficient tax structure

The company’s set up structure has impo...

- Posted 11th March 2015

Importance of Cost Accounting in the Medical Practice

If you are in a medical practice, your patients come first than anything else. When you are busy taking care of your patients, you have hardly enough time to look into your accounts. Although your primary focus should be on them, you should not forget to deal with the aspects of the accounting and finances of the practice you are in. 349...

- Posted 11th March 2015

Do I need an accountant for my business?

If you are planning to start your own business, your accountant will act like your business advisor. They will assist you in formulating and implementing your business plan and take care of all the tax issues that incur while registering a new business.

Hiring an accountant is not only about hiring somebody to manage your money. It is about finding someone to manage your business.

An expert accountant can not only present you the up-to-date information on any legal or general inquiries...

- Posted 11th March 2015

Happy New Year

Wishing Everyone a Very Happy New Year!

https://www.youtube.com/watch?v=6avCY0tWiYQ

...

- Posted 11th March 2015

Five Things to Know About VAT Accounting

If your company is already a VAT registered company in the UK, you probably know about VAT and must have been paying it on purchase of goods or services. You must have also heard about that this type of tax is also charged on the goods and services imported from countries outside the European Union (EU).

Apart from these details, you need to know more about VAT Accounting and should be clear about the following five things. 342...