- Posted 28th August 2015

PAYE (Pay As You Earn)

The Pay As You Earn (PAYE) is a way used by HM Revenue & Customs (HMRC) for collecting income tax and national insurance contributions.

Usually, your employer uses a tax code which is issued by the HMRC. This tax code will tell your employer how much tax needs to be deducted from your pay. If it is not available, an emergency code will be provided to your employer and will be used until a full tax code is issued. After deducting necessary taxes from your wages or occupational pension, you...

- Posted 27th August 2015

How to Claim a Tax Refund

Have you paid too much tax? If you have, you are entitled to claim a tax rebate. Tax overpayments can be made due to several reasons. Sometimes, when wrong tax code is used, too much tax can be deducted.

You can claim a tax rebate in the following cases:

• If you are employed and too much tax has been cut from your pay

• If you were made redundant and you have overpaid tax

• If you have sent tax return and paid too much tax

• If you have more than one occupational pension and your...

- Posted 25th August 2015

Voluntary VAT Registration: Pros & Cons

If you have a business in the UK and your taxable turnover is more than £82,000, then you cannot escape from being a VAT registered. You also need to register for VAT if you receive goods in the UK from the EU worth more than £82,000 and your income is expected to go over the threshold in the next 30 days.

In case if your taxable turnover is less than £82,000, you can register voluntarily. However, before registering, you need to remember that voluntary registration has both benefits and d...

- Posted 23rd August 2015

Pros & Cons of Outsourcing Payroll

Are you fretting over your payroll? If you are, you need to outsource your payroll right away. Not only outsourcing can save your money and time, but it also saves you from headache.

However, whenever you make the decision of outsourcing, you need to consider all the advantages and disadvantages that come with outsourcing.

So, what are the pros and cons of outsourcing your payroll?

Pros

Convenience

As a business owner, outsourcing payroll allows you to focus on your core activities of your bu...

- Posted 21st August 2015

Running a Payroll: Things to Keep in Mind

When it comes to a common problem that every business owner faces, the first place goes to none other than the payroll challenges. Being a business owner, such payroll issues are the number one cause of your employee dissatisfaction.

So, how should you run your payroll to avoid any problems in the future?

First of all, you need to perform certain work during each tax month, which normally runs from the 6th of one month to the 5th of the next month. If you fail to pay your employees in a ta...

- Posted 20th August 2015

Penalties for Filing Incorrect Tax Return

Being a taxpayer, there is a high probability for you to make the mistake of filing incorrect tax returns due to carelessness at some point of time. As a result, you cannot possibly stop hefty penalties on your way.

And, there is HM Revenue & Customs (HMRC) that decides whether you have been careless or deliberately tried to conceal some information from them. Depending on this, you will be charged penalties.

You do not have to pay any penalty if you have filed your tax returns co...

- Posted 19th August 2015

Is Personal Injury Compensation Taxable in the UK?

Are you residing in the UK? If yes, you probably must have an idea what taxable and non-taxable incomes are. But, I bet you may not have full knowledge on these incomes.

There are many incomes like welfare benefits, interest and income from savings and investments which are non-taxable. Likewise, some social security benefits and pensions, work-related income, and some interest on savings are taxable incomes.

Among these incomes, personal injury compensation is one such hot topic where mos...

- Posted 18th August 2015

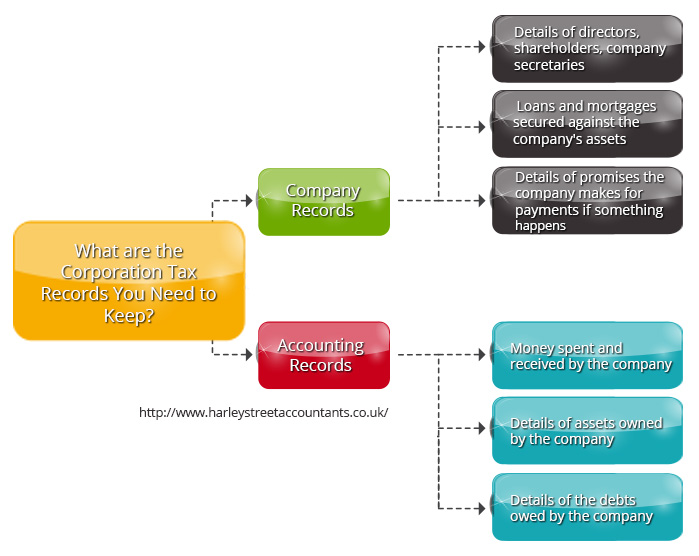

What are the Corporation Tax Records You Need to Keep?

Corporation tax is a tax charged on the profits earned by the businesses during a taxable period. So, if your business is liable for corporation tax, keeping adequate and accurate records is very essential to complete your company tax return.

Here is a list of accounting and company records that you need to maintain.

Company records

Details of directors, shareholders, company secretaries

Results of any shareholder votes and resolutions

Details of promises for the company for re...

- Posted 14th August 2015

VAT Record Keeping: What You Should Know

Are you a VAT registered business in the UK? If you are, you need to keep records of many things.

The things that you need to keep records include:

• All copies of VAT invoices you issue

• All original VAT invoices you receive

• A VAT account

• Any corrections you make to your VAT accounts or invoices

• Self-billing agreements

• Name, address and VAT number of any self-billing suppliers

• Debit or credit notes

• Import and export records

• Records of items you can r...

- Posted 13th August 2015

Emergency Tax Code Explained

Are you working in the UK? If you are, then a tax code is usually used by your employer or pension provider that tells them how much income tax needs to be deducted from your pay or pension.

You get your tax code from your payslips from your employer or pension provider, P45 from an employer when you leave a job, P60 from your employer at the end of each tax year, and a PAYE coding notice.

For those born after 5 April 1938, the current tax code is 1060L.

You also need to remember that ...