- Posted 30th September 2015

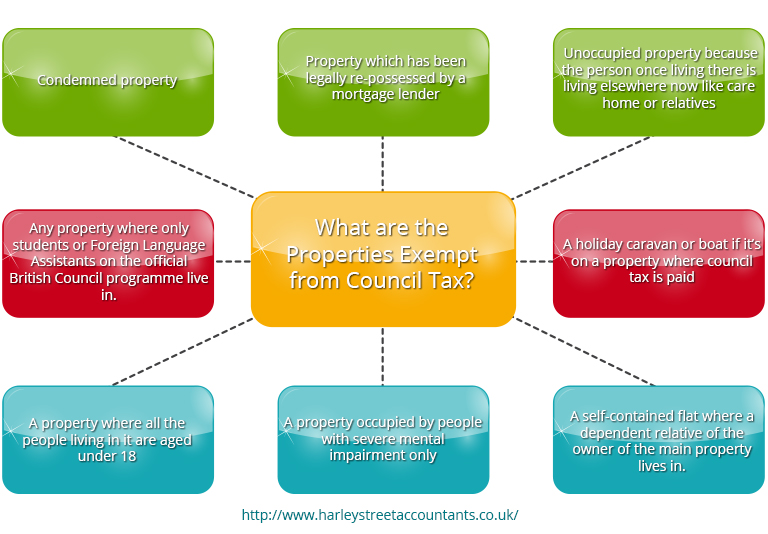

What are the Properties Exempt from Council Tax?

Do you know what Council Tax is? If you don’t, here is a small note for you.

Council tax is a system of local taxation on domestic property collected by local authorities. If you are 18 or over and own or rent a home, then you are required to pay such type of tax. In case if you live on your own and no-else in your home counts as an adult, you will get a discount up to 25%. Alternatively, if no-one living in your home, including you does not count as an adult, a 50% discount will be provide...

- Posted 29th September 2015

How to Prepare for a VAT Visit

Are you getting a VAT visit? If you are, you do not have to worry because such VAT visit is just a routine check-up done by VAT officers to ensure you are paying the right amount of Value Added Tax.

HM Revenue & Customs (HMRC) will usually contact you via a telephone call to arrange for a visit and give you a 7 days’ notice. They will tell you about the information they want to see and whether they want to inspect your premises or not. However, if the time of the visit is inconvenient t...

- Posted 28th September 2015

VAT Cash Accounting Scheme

Cash Accounting Scheme is a scheme that allows you to pay VAT on your sales once you receive payments from your customers. You will also able to reclaim VAT on your purchases once you pay your supplier.

Who can join this scheme?

If you have a VAT registered business with expected VAT taxable turnover of £1.35 million or less in the next 12 months, you can join this scheme. However, if your taxable turnover is more than £1. 6 million, you need to leave this scheme.

Alternatively, if your...

- Posted 27th September 2015

New Accounting Standard for Micro-Entities

The Financial Reporting Council (FRC) has published a new Financial Reporting Standard for the Micro-entities called FRS 105. This marks the end of the Financial Reporting Standard for Smaller Entities (FRSSE).

The key facts about FRS 105 applicable for the Micro-entities regime include:

It is applicable to micro entities for periods on or after 1 January 2016

There is an option for early adoption

It simplifies accounting requirements

The thresholds for Micro-entity companies are:

...

- Posted 25th September 2015

Why Optometrist Needs an Accountant?

Eyes play a very vital function in our lives. And, to maintain its functionality, it is the optometrist who addresses our eye and vision concerns.

Whilst of taking care of eye problems of the patients, the financial matters of the optometrists take a backseat. As a result, managing the finance becomes difficult. Thus, to ensure this doesn’t happen, it is important that optometrists hire qualified optician accountants.

What accountants offer you?

They understand your industry challenges so...

- Posted 23rd September 2015

Accounting Mistakes to Avoid By Pharmacists

Accounting is a very important part of any business so any error can lead to major problems which can affect the business immensely. Even as a pharmacist, you shouldn’t neglect but take care of your accounting matters to ensure your pharmacy is free from any risks.

So, what are the accounting mistakes you need to avoid?

Not knowing your finance

If you don’t know the financial position of your pharmacy, you may not know how much and where the money is going. As a result, setting realis...

- Posted 21st September 2015

Bookkeeping for Doctors

Being in a medical profession, doctors have a very limited time, which makes it hard for them to focus on other things than their work. And, as a result, they fail to realise the importance of maintaining their financial matters.

When you have a bookkeeper, you do not have to worry about your financial affairs because they have knowledge on how to maintain your financial records on a daily basis.

Here is a list of things that your bookkeeper will take care of you on your behalf.

Documen...

- Posted 17th September 2015

What Payments & Benefits are Non-Taxable for Employees?

As an employee, there are a number of both taxable and non-taxable payments and benefits provided by your employer. This is why you need to able to set them apart to ensure you only pay taxes on the taxable ones.

Here is a list of common payments and benefits which are non-taxable.

Accommodation, supplies, and services on your employer’s business premises

Supplies and services provided to you other than on your employer’s premises for performing your duties but doesn’t apply to mo...

- Posted 15th September 2015

Self-Assessment Tax Records

Are you self-employed in the UK? If you are, you need to pay taxes at the right time to the HM Revenue & Customs (HMRC) to ensure you steer clear from penalties.

HMRC uses a system for collecting the income tax from you where tax is usually deducted from your wages, pensions or savings. This system is known as the self-assessment.

You will need to keep tax records for filing and completing self-assessment tax return. Such records include details of all your business income and outgoing...

- Posted 14th September 2015

Capital Gains Tax on Property Explained

Have you made any profits from selling your property? If you have, then you are required pay Capital Gains Tax on such profits. However, such tax is normally not charged on the gains made from your main home as it will be eligible for private residence relief (PRR).

In case if you own more than one home, you can elect any one of them to be tax-free. If you have let some part or whole home, a proportion of any gain made with the letting can be taxed when selling your home.

If you provide ge...