- Posted 23rd April 2015

What is Real Time Information (RTI)?

Real Time Information (RTI) is a programme introduced by HM Revenue & Customs to improve the accuracy of PAYE and thus reducing the possibility of fraud. This was brought into effect from 2013.

Under this new RTI, the employers need to submit the information electronically to HMRC ‘on or before’ paying their employees. When RTI was not introduced, the employers were required to submit just once a year. This means all the employers need to make more regular submissions than before.

RTI ...

- Posted 20th April 2015

Duties of a Medical Accountant

If you are a doctor, managing accounting and tax procedures and concentrating on your profession at the same time becomes nearly impossible. On top of that, you barely have knowledge on the rules and regulations of these subjects. That is why hiring an expert medical accountant is important for handling all of your accounts and tax matters.

An accountant needs to perform a number of duties to manage the tax affairs and the financial aspect of your practice in the best way possible.

• Be able...

- Posted 17th April 2015

National Minimum Wage Increment Announcement

The Prime Minister and the Deputy Prime Minister have announced that the National Minimum Wage (NMW) for the adults will be increased by 3 % to a rate of £6.70 per hour. This will be on effect from 1 October 2015.

They have also announced the increase in the National Minimum Wage for apprentices by 57 pence an hour to a rate of £3.30 which is the largest ever increase in the National Minimum Wage for apprentices.

The government implemented a higher rate with the intention that apprentice...

- Posted 16th April 2015

Five Tips for Bookkeeping

Doing your own financial books may seem a bit difficult than you imagine. But, that shouldn’t stop you from doing it. As bookkeeping is a very important part of your business, here is a breakdown of tips for doing it on your own.

Keep your financial records

Keep records of your finances from the very beginning. Along with the updated financial information, remember all the important dates for paying tax or VAT. In case, if you do not meet the deadline and make late payments, costly penal...

- Posted 15th April 2015

Dentistry Show 2015

The Dentistry Show is a free two-day event which offers a wide range of products & services, verifiable CPD lectures and networking opportunities to the dental professionals. So, if you are a dental professional, make sure you do not miss this show.

The shows are set to be attended by more than 7000 dental professionals from all over the UK. There are also 400 and over dental manufacturers and suppliers to be in attendance.

With so many professionals on attendance, you can also enjoy educa...

- Posted 13th April 2015

Labour Plans to Raise 7.5 Billion from Tax Avoidance

Labour is planning to raise 7.5 billion pounds by introducing a range of measures for clamp down on aggressive tax avoidance and evasion.

Along with that, Labour will carry out an immediate review of tax collection system for closing loopholes for tax avoiders if it wins power in May.

Labour has also outlined plans for imposing higher fines on tax avoiders. These include changes to the ‘carried interest’ rules. These rules enable private equity managers to pay lower rates of capital ga...

- Posted 10th April 2015

Common Self-Assessment Tax Return Mistakes

HM Revenue & Customs (HMRC) sends a notice to everyone in Self-Assessment system on the month of April each year. If you have received such notice, submit a Self Assessment Tax Return (SATR) on time and correctly for avoiding penalties.

If you are submitting paper returns, then it needs to be submitted to HMRC by 31 October. However, if you choose to submit tax returns online, it must be done by 31 January.

Many errors made on Self-Assessment tax return can cause HMRC to track you down...

- Posted 9th April 2015

Top Five Tips for Reducing Inheritance Tax Liabilities

Inheritance tax (IHT) is a tax paid when your estate is worth more than £325,000 at the time of your death. Such IHT payable can be reduced when you carry out a good plan.

Here are some important tips that can help you reduce the taxman’s cut.

Set up a will

Setting up a will make both your wishes and certain matters carried out in a tax-efficient way. This means you do not have to rely on intestacy rules that come into play where there is no will.

If you are not married but have c...

- Posted 8th April 2015

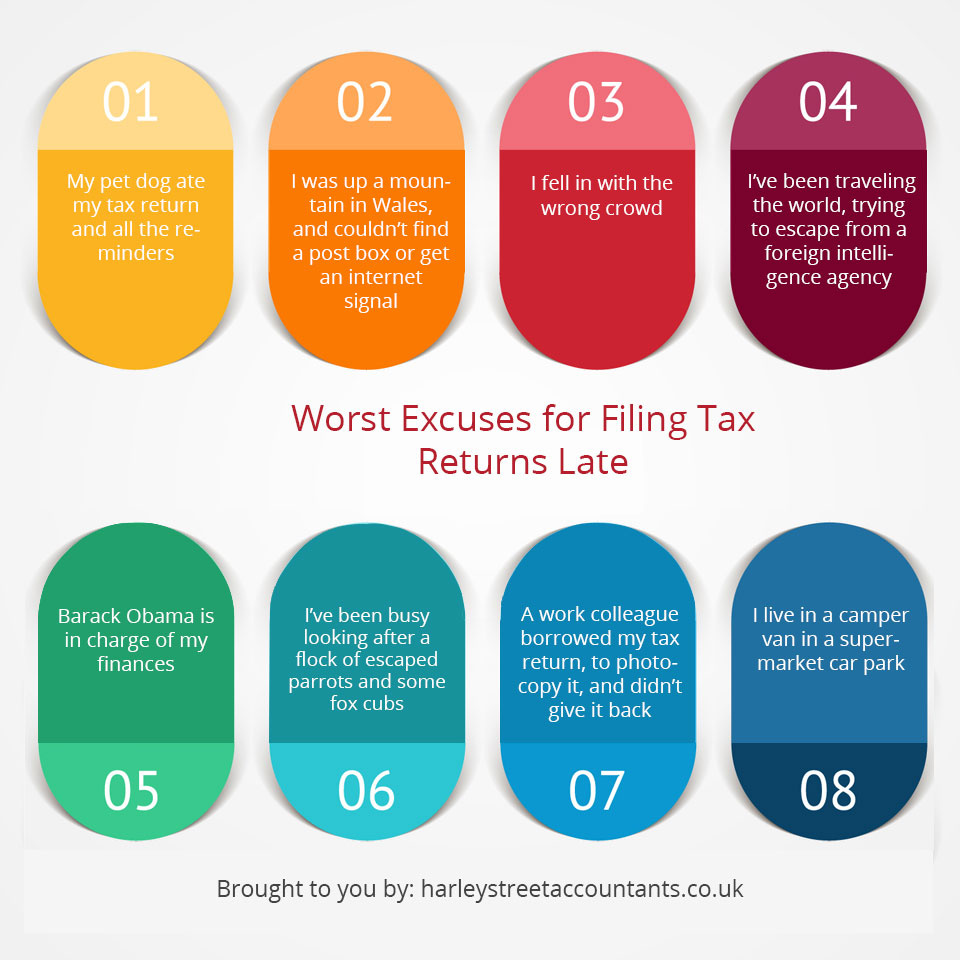

Top 10 Worst Excuses for Filing Tax Returns Late

When there is a late filing of tax returns, many people come up with absurd excuses only for avoiding paying a penalty. HM Revenue & Customs (HMRC) receives lot of them which only becomes a cause of laughing stock. We have accumulated a list of top ten lists of worst excuses published by HMRC.

• My pet dog ate my tax return…and all the reminders

• I was up a mountain in Wales, and couldn’t find a post box or get an internet signal

• I fell in with the wrong crowd

• I’...

- Posted 7th April 2015

Why is Medical Accountant Essential for a Medical Practice?

Medical business is such business where patients come first more than anything. If you are a medical professional, then you know this by heart.

In a profession where you are constantly juggling your time between work, family, and yourself, taking care of your finance can literally make you exhausted. On such scenario, having a good medical accountant who can look after your financial matters can be a boon to you.

Here are the reasons on how accountants play an important part in your medica...