- Posted 11th June 2015

Five Common Tax Mistakes Made by Small Business

As a small business owner, have you already committed a tax mistake? If yes, you need to stop fretting over your mistakes. Instead you need to learn about your mistakes to make sure you do not repeat them again.

Here is a list of common tax errors which are usually made by small business owners like you.

Not being updated about current tax laws

Generally, taxes like income tax, payroll taxes are known among the small businesses. As a small business owner, you are familiar with all the detai...

- Posted 10th June 2015

Surcharges & Penalties for Late Filing & Payments of VAT

In the previous blog post, we talked about penalties for late filing and payment of self-assessment tax. And, this time, we have a post about VAT surcharges and penalties in case of late filing and payments.

If you are VAT registered businesses in the UK, you need to file and pay your VAT before the deadlines. That’s because the surcharges and penalties you can face on the late filing and payments are becoming stricter than ever.

When you fail to file a return before the deadline, HM Rev...

- Posted 9th June 2015

Penalties for Late Filing & Payments of Self-Assessment Tax

Tax is something that all of us are familiar with. However, sometimes due to carelessness, when you forgot about paying taxes, you can be charged with penalties. And, mind you, such penalties can be very expensive and make a dent in your bank account.

If you are a business owner, you need to be very careful and stay away from penalties in order to run your business efficiently.

Self-assessment tax is one such tax for which penalties are charged in case if you fail to file and pay at right ...

- Posted 3rd June 2015

What Personal Skills Should a Dentist Require?

As a dentist, do you think that technical skills are the most important? If you do, then it is time you know something about personal skills.

Personal skills are the soft skills which are associated with your personalities and behaviours that help to embody your relationship with people. But, why do personal skills matter? It is because patients prefer the ones who treat them with care and answer their queries in a gentle manner and not the one who is inflexible.

Even though there are many...

- Posted 2nd June 2015

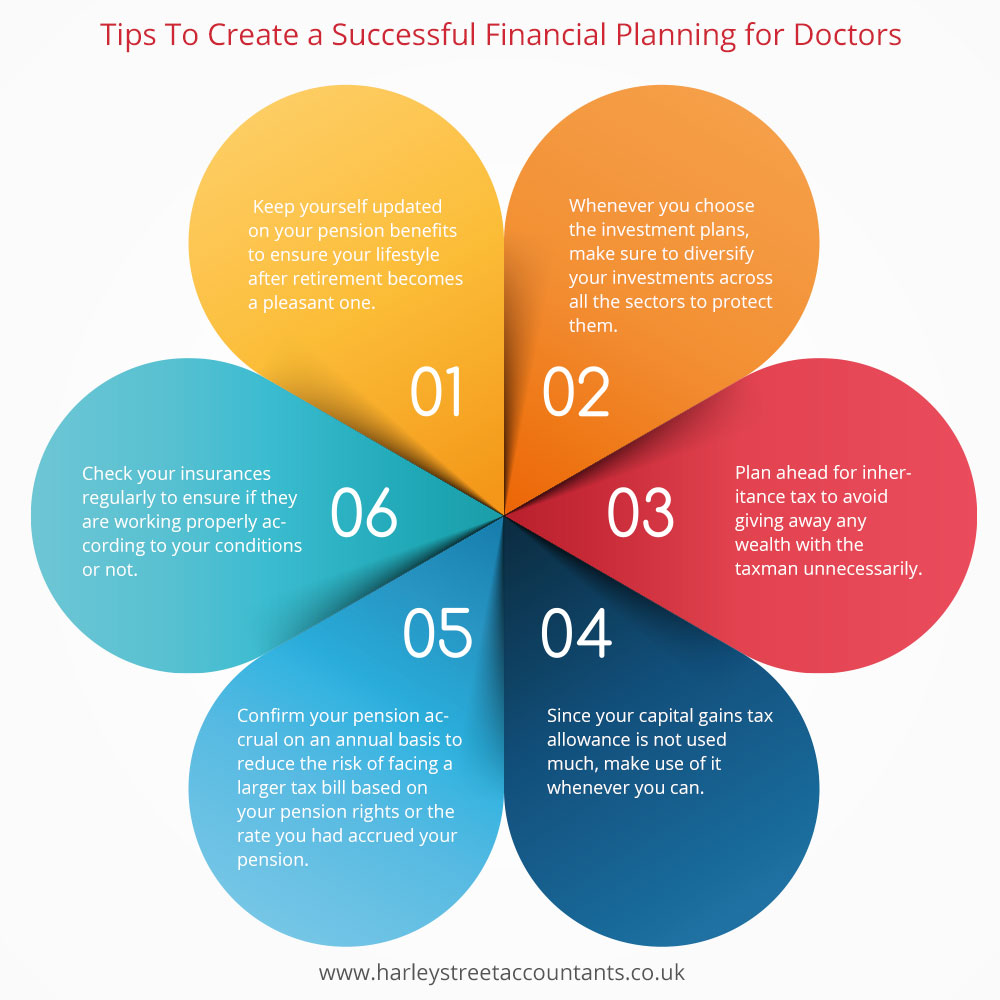

Tips To Create a Successful Financial Planning for Doctors

When you work as a doctor, you usually have a very busy schedule which makes it hard for you to focus on other things than your job. Even so, it is important you take out time from your busy timetable to take care of your finance in order to be secured in your future after your retirement.

So, how do you control and secure your financial life? The solution is to prepare a sound financial planning and work according to it.

• Being a doctor, you are automatically entitled to some pensi...

- Posted 1st June 2015

Many GPs Not Happy With the Seven Days Working Policy

With the Prime Minister David Cameron’s announcement that GPs should be available for seven days a week, this news have not been a good thing for the GPs.

According to the announcement, around 5,000 GPs is said to be recruited. However, many general practitioners are now leaving their practice leaving this much under speculation whether the defined number could be recruited or not.

The chairman of the British Medical Association’s GP committee, Dr Chaand Nagpaul has said GPs are alread...

- Posted 31st May 2015

Smart Ways to Manage Your Cash Flow and Profit

Cash flow has become one of the serious issues in small businesses. It's even more complicated when your business is profitable. In fact, many businesses with high profit, can get ruined if they don't have enough cash to fund the business.

Profit is not the only source to generate cash. You can actually create cash for the business by contributing personal funds, selling assets or using bank loans. So, if you are confused on why you are able to make profit, but no cash, then you should follow t...

- Posted 28th May 2015

Top Six Tax Reliefs for SMEs in 2015

There are number of businesses taking advantages of their tax breaks in this tax year. On the other hand, there are some small and medium sized business owners who aren’t aware about such tax breaks that they are entitled to. Being a business owner, not only such reliefs can help to run your daily business operations efficiently but also helps in growing your business.

Look at the list to below to ensure you are not missing out anything.

Research & Development

Over the years, the ...

- Posted 27th May 2015

New Deal for GPs in the UK

The Government promises to provide a ‘new deal’ for general practitioners (GPs) and recruit 5,000 new GPs including a review of the GP contract.

Prime Minister David Cameron has said that a ‘seven day’ working National Health Service (NHS) will be implemented with the aim to provide better services and save lives of the patients.

He added that the new deal for GPs will include more investment, training and personal link with patients giving access to new drugs and treatments. And, ...

- Posted 24th May 2015

FAQs: Tax Investigations

Nobody likes tax investigations. However, if you are selected for a one, you need to stay calm and get plenty of information about such investigations.

So, what are the commonly asked questions about tax investigations? To find out, you need to read the pointers below.

What is a tax investigation?

Tax investigation is a thorough investigation done by the authority to recover the unpaid taxes. In the UK, HMRC send officers for tax investigation compliance checks if they suspect any deceitf...