- Posted 25th June 2015

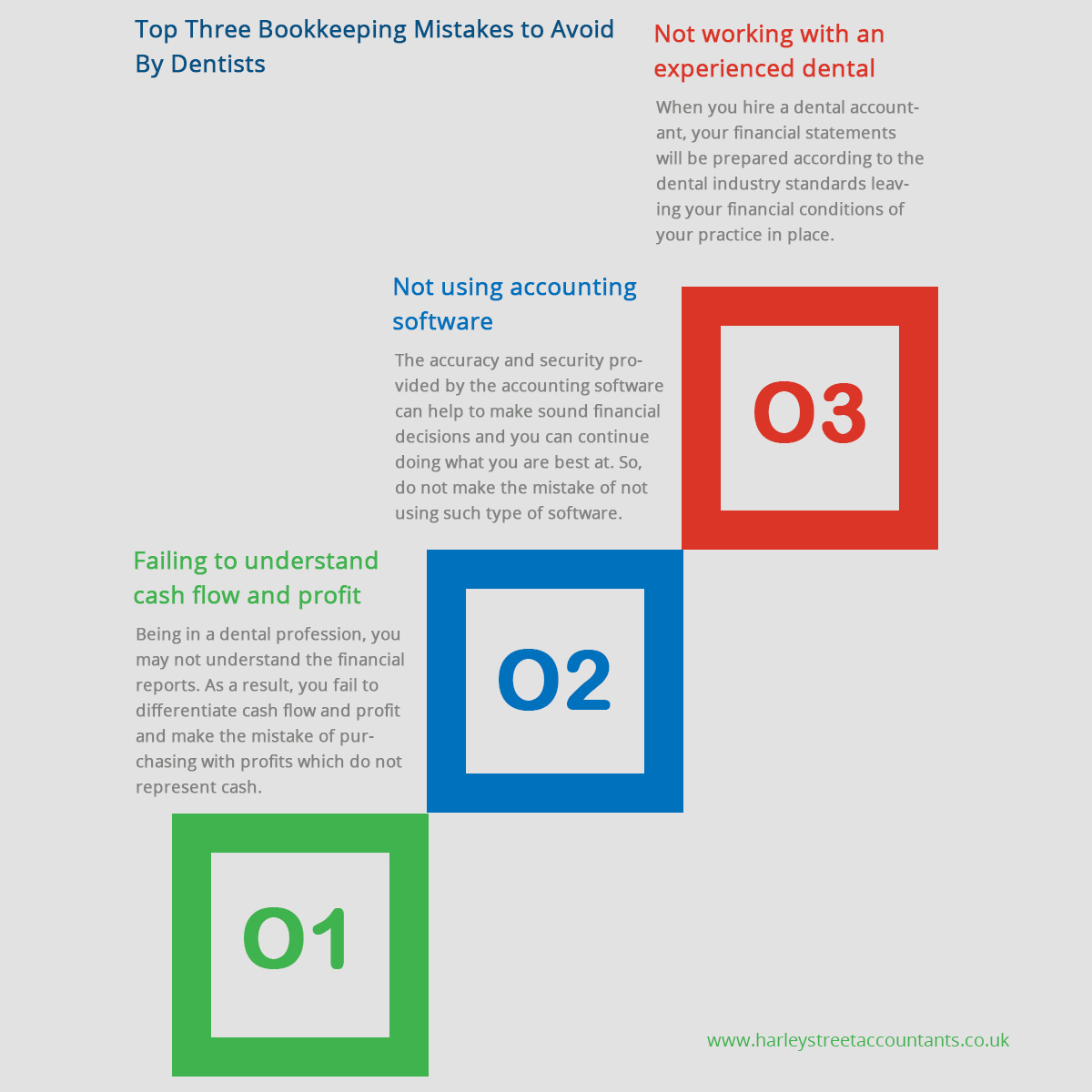

Top Three Bookkeeping Mistakes to Avoid By Dentists

As a dentist, when it comes to performing a teeth check-up or spotting a cavity, you do your job spot-on with finesse. However, bookkeeping is different from your usual work and you may lack skills for doing bookkeeping effectively.

So, what are the common bookkeeping mistakes that are usually made by dentist?

1. Failing to understand cash flow and profit

Being in a dental profession, you may not understand the financial reports. As a result, you fail to differentiate cash flow and prof...

- Posted 23rd June 2015

What are the Common Errors Made in Dental Practice?

When you are working as dentist, focusing on your job and patients all day makes you weary and tired. With such weariness, you can hardly have time and energy to understand and look after your tax matters. The terms used in this subject are almost foreign to you. As a result, you end up paying more tax than you are supposed to.

So, what are the common errors that most of the dentists including you have made in your dental career? Read the points below to find out.

Mixing personal and practice...

- Posted 19th June 2015

VAT Inspection Explained

Are you a VAT registered business in the UK? If you are, you can receive a VAT inspection at some point of time. So, when you receive a one, you need to be prepared and not panic at all.

It is just a routine check done by the HM Revenue & Customs (HMRC) to ensure improved compliance among businesses and increase the collection of right amount of VAT.

Why are you being inspected?

Your VAT returns have failed a credibility check at the VAT Central Unit

Your business is regarded as hi...

- Posted 18th June 2015

NHS Pension Scheme 2015

NHS Pension Scheme is considered as the comprehensive public benefit service schemes within the UK. And, whenever you start working for NHS, you are automatically included in the NHS Pension Scheme.

From 1 April 2015, a new NHS Pension scheme came into effect which covers both the transitioning and new NHS employees.

The main features of this scheme:

It is a Career Average Revalued Earnings (CARE). This defined benefit pension scheme provides benefits based on a proportion of pensionab...

- Posted 18th June 2015

Tax Free & Chargeable Capital Gains

Capital Gains Tax (CGT) is a tax which is charged on the profit in value of possessions from selling or disposing of a property or an investment. This charge is applicable to individuals and trustees but not to Limited Companies.

While some of the assets are tax free, you don’t have to pay such tax if all of your gains in a year fall under tax free allowance.

List of chargeable capital gains

Personal possessions worth £6,000 or more, apart from your car

Property ( not your main home...

- Posted 16th June 2015

What Qualities Should Accountants Require?

Are you doing accounts on your own? If you are, then let me warn you it can be a real mess especially if it is not your specialty. This is why it is always better idea to take guidance from professional accountants who have expertise on such matters.

But, before deciding to hire accountants, you should be smart enough to know that they have all the right qualities to perform the job perfectly.

Client focused

A good accountant values each client of his/hers and put them before their personal...

- Posted 16th June 2015

Clampdown on Aggressive Tax Evasion

Tax evasion has been a constant topic in the media for quite a while that now we understand what it is. The single legality element that differentiates it from the tax avoidance is a point which makes a whole lot of difference.

In February, when the news hit nationwide about the scandal involving Swiss banking operations of HSBC, M Revenue & Customs (HMRC) came under a lot of intense scrutiny. However, they defended by saying they didn’t had any strong evidence to prosecute in this case...

- Posted 15th June 2015

Five Ways to Reduce Your Tax Bills

As a taxpayer, you certainly cannot ignore your tax that has to be paid. But, what you can do is look for ways to reduce it.

To help you reduce your tax bill, here is a list of useful tips just for you.

1. Top up your pension

Making payments into your pension can help reduce the tax. Thus, if you have planned to work past state retirement age, making payments into your pension will reduce adjusted net income used for calculating personal allowance.

If you have got an occupational income,...

- Posted 14th June 2015

Things to Know About Corporate Tax

Do you own a limited company? If yes, then corporation tax is not a new topic for you. On the other hand, others may consider it same as other taxes. So, here is a brief note on what corporate tax is, how and when should it be paid.

What is corporation tax?

It is a tax which the limited company must pay on its taxable profits. However, the rate on which you have to pay the tax depends on the profit you have created.

Within the three months of the start of your company’s accounting period...

- Posted 12th June 2015

How Should Doctors Manage Cash flow

Cashflows is the one of the most important things that helps sustain a business. However, it is not easy to manage the cashflow and has been a major issue in all types of businesses including the medical practice.

Poor planning, poor quality of financial information, too much overheads and debt are the some of the factors that often led to cashflow problems. And, due to the constant economic stress, doctors are involved in more diversified practices for improving their cashflows today.

...