- Posted 12th August 2015

Things to Consider When Buying a Dental Practice

Buying a dental practice involves many things which make it a complex and stressful process. As the dentistry is regulated, you must take several things into consideration to ensure no legal issue arise.

So, what are things that should be considered when buying a dental practice?

Make a timeline

Buying a practice can take up more time than you have expected it to be. For this reason, it is best to factor in a lot more time than you expected before the whole buying process gets started.

Inhe...

- Posted 11th August 2015

VAT Flat Rate Scheme

The VAT flat rate scheme may seem simple, but in reality this scheme can cause confusion for the businesses.

Under a flat rate scheme, you need to pay a fixed rate of VAT over to HM Revenue & Customs (HMRC). Then after, you keep the difference between what you charge your customers and pay to HMRC as your profit. Also, you cannot reclaim the VAT on purchases except for capital asset purchases over £2,000.

When you join such scheme, there are plenty of merits you could enjoy. For instance,...

- Posted 10th August 2015

Corporate Tax: Allowances & Reliefs

Corporate taxes liable on the taxable profits made by the businesses in the UK during a particular accounting period. Although the corporate tax is a bit complex, it is manageable if handled properly.

The main rate of Corporation Tax currently lies at 20%. However, according to the announcement made by the Chancellor, it will drop from 20% to 19% in 2017 and further to 18% in 2020 for the purpose of benefitting the businesses in the UK.

When calculating your taxable profit, business expens...

- Posted 9th August 2015

How to Work out VAT on a Calculator

Value Added Tax (VAT) is charged on most goods and services purchased from the VAT registered businesses at standard rate of 20% in the UK. In addition, goods and some services that are imported from countries outside the European Union (EU), and brought into the UK are also charged with VAT.

Apart from the standard rate, there are other rates which apply to the goods and services. A reduced rate of 5% is applied on domestic fuel and power, residential conversions, children's car seats, etc. ...

- Posted 7th August 2015

What are the Common Bookkeeping Mistakes to Avoid?

Recording each financial detail may not seem a fun task. But trust me; doing this can save your money and time and most importantly from the stress later on.

You should know that bookkeeping is a significant part of any business where simple errors can cost you money. So, what are the bookkeeping mistakes that you should avoid?

Mixing personal and business finances

When you keep your company and personal accounts separate, it will be easier for you to organise your company accounts. If you ...

- Posted 6th August 2015

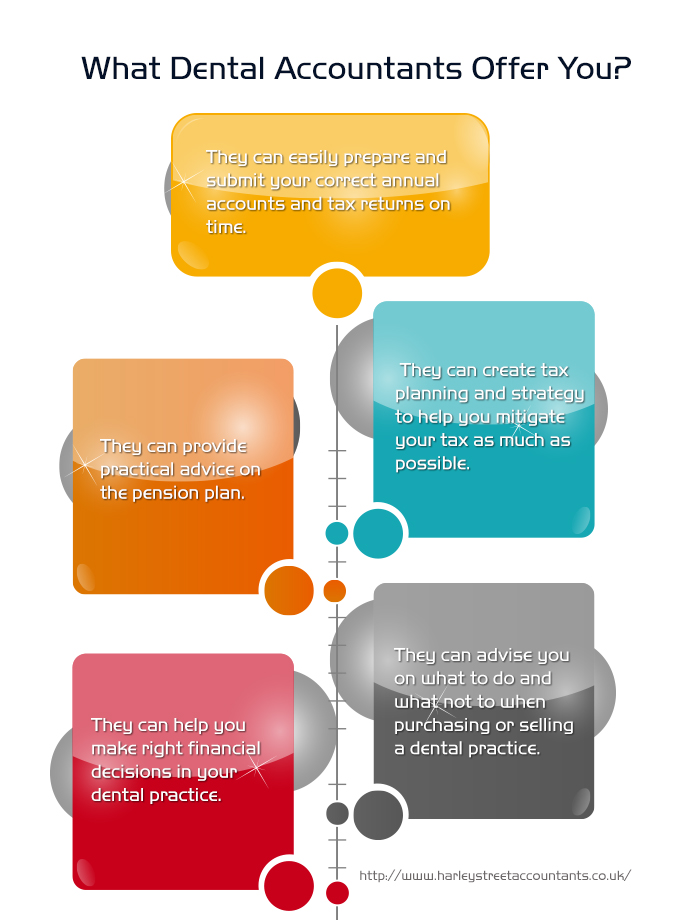

What Dental Accountants Offer You?

When you are in a dental practice, working and running your practice at the same time can be a difficult process. Furthermore, you may not have the expertise for creating financial planning and management required for a successful dental practice.

Without understanding the intricacies of accountancy and taxation, keeping control of the finance of your practice is almost impossible. Thus, to help you achieve your financial goals, you need to consult expert dental accountants.

Dental accountan...

- Posted 5th August 2015

The New UK GAAP: List of Standards

Have you heard about the new UK GAAP before? If not, you can learn and know more about it right now.

From 1 January 2015, a new financial reporting framework came into effect in the UK. The old system’s complexity and nature are the reasons for creating this new framework. The UK's Financial Reporting Council (FRC) published five standard reporting frameworks which form the basis of the new UK regime and replaced the old system.

So, what are the new reporting standards of the new UK regime? ...

- Posted 4th August 2015

Will the National Minimum Wage Raise Work?

According to the announcement made by the Chancellor, George Osborne, the national minimum wage in the UK will be increased to £6.70 per hour from October 2015 and £7.20 per hour from April 2016 for workers aged 25 and over. This means this change will not have any affect under the age of 25. And, by 2020, the national minimum wage is set to be £9 per hour.

The current national minimum wage is £6.50 per hour for over 21s.

Likewise, the minimum wage for 18 to 20-year-olds will go up...

- Posted 3rd August 2015

What You Need to Know About Income Tax?

Do you know what income tax is? Well, it is a tax which you need to pay on your income or earnings. This income tax you pay in each tax year depends on how much of your income is above your Personal Allowance and how much of it falls within each tax band. The tax year normally runs from 6 April one year to 5 April the following year. However, you don’t have to pay such of type of tax on all types of income.

Here is a list of the income where you do not have to pay your income tax and are tax-...

- Posted 2nd August 2015

National Insurance Contributions

As National Insurance (NI) is a tax paid on earnings and self-employed benefits, anyone residing in the UK must be familiar with this term.

If you are employed, National Insurance is automatically deducted from your monthly pay. On the other hand, you have to make contributions yourself if you are self-employed. However, all of you may not be aware about every benefit you are entitled to when you pay such National Insurance.

To ensure you get to enjoy your contributions, here is a list of ...