- Posted 18th August 2015

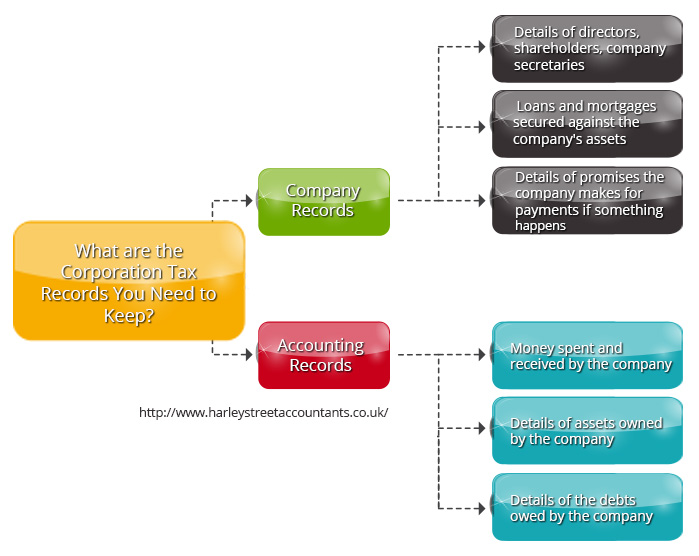

What are the Corporation Tax Records You Need to Keep?

Corporation tax is a tax charged on the profits earned by the businesses during a taxable period. So, if your business is liable for corporation tax, keeping adequate and accurate records is very essential to complete your company tax return.

Here is a list of accounting and company records that you need to maintain.

Company records

Company records

- Details of directors, shareholders, company secretaries

- Results of any shareholder votes and resolutions

- Details of promises for the company for repaying loans at specific date in the future and who they must be paid back to

- Details of promises the company makes for payments if something happens and it’s the company’s fault

- Information about transactions when someone buys shares in the company

- Loans and mortgages secured against the company’s assets

- Money spent and received by the company

- Details of assets owned by the company

- Details about the debts owed by the company

- Company’s stocks owned at the end of the financial year

- The stocktakings used to work out the stock figure

- Sold and bought goods

- Details of who you bought the goods from and sold them to